Insurance

What is underinsurance and how might it affect you?

Nov 5, 2025

What is underinsurance and how might it affect you?

Underinsurance is what happens when your home insurance policy doesn't provide enough coverage to completely rebuild your home after a disaster. This guide shares essential tips on how to assess your coverage, help you understand your personal risks of being underinsured, and what steps you can take to ensure adequate protection in the future.

How widespread is underinsurance?

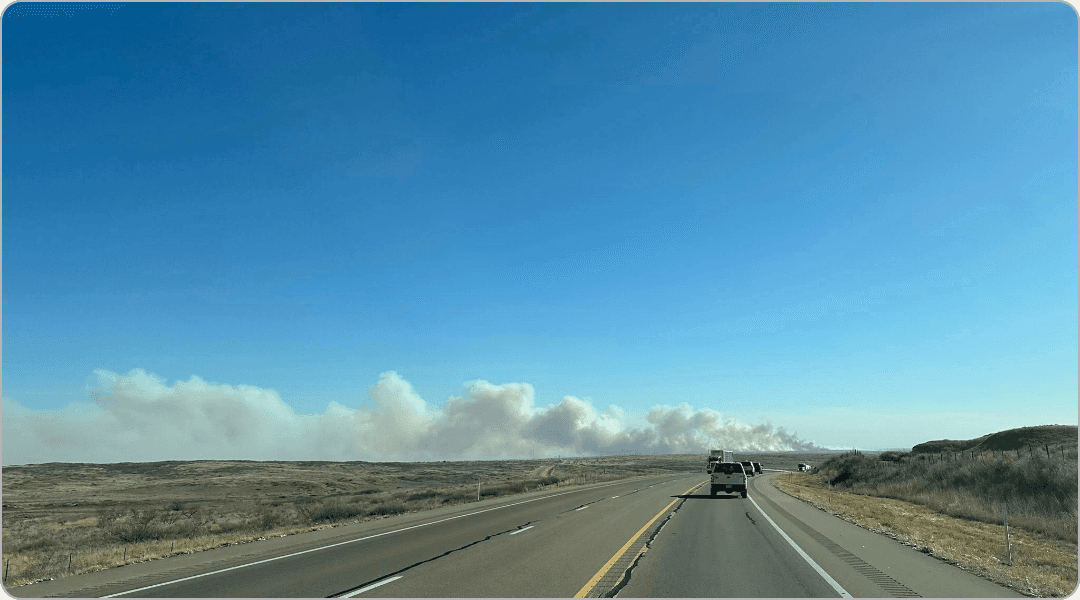

Underinsurance is prevalent, with multiple industry groups estimating a majority of American homeowners don’t carry policies that can cover 100% of their replacement costs. According to a University of Colorado study, 74% of affected residents had inadequate insurance coverage in the wake of the Marshall Fires near Boulder, CO.

When your home insurance policy can't provide enough coverage to fully rebuild, repair, or replace your home (including your belongings) after a loss, you’re not only underinsured, you’re also risking your financial safety. You are personally responsible for covering any financial gap between your insurance payout and the actual cost of recovering your home.

Examples

Replacement Cost Gap: Your home was insured for up to $250,000 when you bought it ten years ago, but rebuilding after a fire might cost $350,000 today

Contents Undervaluation: Your belongings inside your home are worth $100,000, but you only had $60,000 in contents coverage

Improvement Oversight: You renovated your kitchen for $50,000 two years ago but never updated your coverage limits

Root Causes of Home Underinsurance

The most common issue is when people buy a home, they also purchase a home insurance policy to cover it at the time of purchase. But unless you review your policy every few years, you can get into a situation where your insurance coverage is years out of date with current inflation and construction costs.

In the past five years, building costs—including raw materials and labor—have risen significantly. Weather and climate disasters are also on the rise, with 28 separate incidents in 2023 that caused over $1 billion in losses each. Insurance premiums nationwide are rising fast to cover it all and many homeowners choose to keep their premiums low instead of upgrading to adequate coverage.

Generally speaking, home values tend to increase over time and the longer people own homes, the more likely they are to renovate and improve their residence. Both may lead to the need for increased coverage but often homeowners base their insurance policy premiums around mortgage amounts rather than real replacement costs.

Replacement costs don’t include the land they are located on, and in expensive locations, your total insurance policy required may be well under the market value of the home, but in less expensive areas, you may need insurance beyond market value to completely cover costs. Here are a couple of example scenarios:

An expensive home in Miami, Florida:

Market Value: $2,000,000 (includes $800,000 land value, near a waterfront with a view)

Rebuild Cost: $1,200,000 (just the structure)

Insurance needed: $1,200,000+ (not $2,000,000)

A less expensive home in Tulsa, Oklahoma:

Market Value: $300,000 (includes $50,000 land value)

Rebuild Cost: $400,000 (higher construction costs than market values)

Insurance needed: $400,000+ (more than market value!)

Real-world consequences of underinsurance

Here are some additional examples of what an underinsurance situation would look like in the case of a total loss from fire damage and a partial rebuild after a severe storm:

Fire loss: A home insured for $200,000 suffers extensive fire damage. Rebuilding costs are $300,000. The family must:

Pay their deductible (e.g., $2,500)

Cover the $100,000 coverage gap through loans

Handle temporary housing costs beyond any policy limits while rebuilding takes place

Deal with any shortfalls from replacing the contents of their home

Storm damage: After a storm, a homeowner discovers:

Home replacement cost has increased 25% due to inflation from the time the policy began

New building codes require expensive upgrades

Costs of debris removal exceeds policy limits

Additional living expenses stretch beyond coverage periods

The impacts of either scenario can be devastating. Through no fault of their own, a family hit by a natural disaster now has to grapple with new loans and debt to cover shortfalls, find long-term temporary housing while rebuilding takes place, all while dealing with the emotional stress of the ordeal.

Types of Home Insurance Underinsurance

For dwellings, your most critical coverage should be having enough to cover the total cost of replacing the physical structure of your home. It should be based on real replacement costs, not just the current market value of your home, or any remaining mortgage amounts. Dwelling coverage must account for local labor and material costs as well as any building code changes since purchase. Don’t forget to adjust for inflation by reviewing your policy every year or two.

For your personal property inside your home, you can get a rough estimate of how much coverage you need if you do a quick contents inventory of the largest items in each room of your home. Personal property insurance is often set as a percentage of total dwelling coverage so having a preliminary inventory of pricing estimates on your largest items will let you know if your coverage is in the ballpark for your needs.

Additional living expenses (ALE) are another important consideration in an insurance policy. ALE covers all the costs of temporary housing and relocation, including hotels, house rentals, as well as your food and living expenses. Most policies will set either a time period or a total dollar amount, which you can use to estimate how long it would last for you personally. But with typical replacement rebuilds taking up to 2 years or more, be sure your policy amount is high enough to cover a longer timeframe.

Most home policies also cover other structures on your property, so if you have any unattached garages, sheds, fences, or decks, include those in your replacement calculations when checking if your coverage is adequate for replacement.

How to ensure adequate coverage

It’s a good idea to look over your policy once every couple of years. Pay attention to news about local trends in construction costs and materials and try out an online app like https://www.costtobuild.net/ to get a better idea of how your total replacement costs might compare it with your current insurance coverage.

There are several options to explore around your home insurance coverage. The most important is usually called an inflation guard, and it automatically increases your coverage each year to align with inflationary trends. You’ll typically see your total coverage increase by 2-4% annually and your annual premiums may also rise by a small amount each year, but it helps ensure your coverage matches changes in the economy.

You should also look into guaranteed replacement cost or extended replacement cost coverage plans. This option pays for full rebuild costs over your policy limits, but they’re not available in all areas and may increase your premiums. Many policies also offer replacement cost coverage options for your personal property, instead of the depreciated value of your items (with it, a $1,000 TV lost in a fire would get you a check for $1000 instead of ~$500 it was worth at the time). And finally, to be most safe, you should consider an umbrella policy for your home that covers all sorts of extraordinary circumstances well beyond most standard homeowner policies.

Don’t forget to also revisit your coverage after any home renovations or additions, or major purchases of appliances or jewelry.

What to Do If You're Underinsured

If you’ve determined that your home is currently underinsured, there are a variety of steps you can take to remedy the situation.

Your first step should be to call your insurance agent and inquire about the costs of increasing your coverage limits to adequate amounts. If, during your research you figured out any of your coverage was too high, also inquire about reducing coverage where it isn’t needed to offset any premium costs. Ask if your policy can add inflation-adjustment options to ensure you won’t slip back into underinsurance in the future.

In the event something happens and you need to make a claim with inadequate coverage, remember that you can and should appeal insurance company settlement offers if they’re grossly under what is required for full rebuilding. Provide detailed documentation of costs along with estimates from independent contractors.

An action plan for what’s next

Underinsurance is a serious and growing threat to every homeowner’s financial security. With a majority of US properties potentially underinsured and construction costs continuing to rise, proactive management of your coverage is essential.

Here are some things you can do immediately:

Schedule a coverage review with your insurance agent in the next month

Calculate your home's replacement cost using online tools or professional appraisers

Conduct a rough contents inventory estimate to document all your high-value items

Review your policy for exclusions, limits, and coverage gaps

Set reminders to review and update coverage every couple years

Adequate home insurance coverage is not a "set it and forget it" kind of decision. It requires ongoing attention, semi-annual updates, and a clear understanding of your property's true replacement value. The cost of maintaining proper coverage is minimal compared to the financial devastation that can result from being underinsured when disaster strikes, so it’s worth taking the effort today to review your policy and come up with a plan to fix it if you find the coverage inadequate.

Remember: Your home is likely your largest asset. Protecting it should be a top financial priority, as this is not an area where you can save money by cutting corners on coverage.